Numerous business transactions occur within a year. These are then to be summarized in a clear and structured manner at the end of a financial year. Under certain conditions, it can be useful to set the financial year independently of the calendar year. Here you can find out what you should pay attention to when making this change and what impact the fiscal year will have on your company:

What is a fiscal year?

The fiscal year is the period between two balance sheet dates for your company. Since annual financial statements have to be drawn up at the end of a financial year , this covers an entire accounting period. Commercial law defines the financial year as the period in which all economic activities of your company are processed with the help of the annual financial statements. The annual financial statements are, in turn, the arithmetical closing of an accounting period and describe the success or failure of the previous financial year. In English-speaking countries, the financial year is known as the “financial year” . The tax law, however, uses the expression ” fiscal year orFinancial year “.

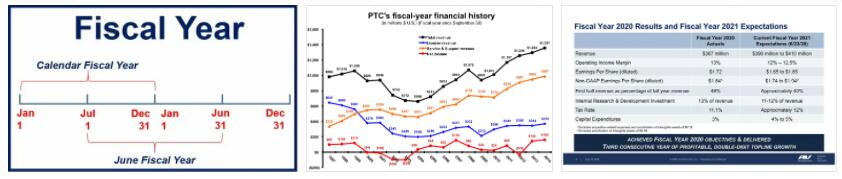

Does the business year mean the same as the calendar year?

“What does calendar year mean?” – in order to get to the bottom of the difference between calendar year and fiscal year, the first question that arises is what a calendar year actually is. The general calendar year definition describes that this begins on January 1st of each year and ends on December 31st. ends of the same year. Since the duration of a fiscal year is also twelve months, they have something in common. Since the fiscal year begins when your company is founded, it often automatically deviates from the calendar year. Accordingly, the annual financial statements must be prepared at the end of the financial year and not at the end of the calendar year.

What is a different fiscal year?

A different fiscal year is used if the fiscal year of your company does not coincide with the calendar year. So your business year doesn’t end on December 31st. one year, but for example in summer.

What are the advantages and disadvantages of a different fiscal year for you?

Each circumstance has its own personal advantages and disadvantages. If the fiscal year deviates from the calendar year, the following positive and negative effects are to be expected:

| advantages | disadvantage |

| Annual financial statements can be moved to a quieter period such as the summer months | individual statutes necessary, which increases the costs for the notarial certification |

| the expenses associated with the annual financial statements initially remain with the company | |

| the bureaucratic expenses can be handled outside of the main season | |

| Inventory relief if the balance sheet date is selected at the time when stocks are low |

When do you have to prepare your annual financial statements for a fiscal year?

Depending on the type of your company, the annual financial statements vary in length. While freelancers and small business owners are only required to prepare an income statement (EÜR) , corporations and partnerships have to prepare a complete annual financial statement. Sole traders whose sales revenues and annual surplus are below a set limit are also relieved of their burden of proof . Nevertheless, the financial year is by no means losing its importance for individual companies.

A complete annual financial statement includes the income statement (GUV) and the final balance sheet . Depending on the size of your company, you should adhere to the following deadlines when preparing your annual financial statements:

| Company size | Deadline after the balance sheet date |

| Small corporations | 6 months |

| Medium-sized corporations | 3 months |

| Big corporations | 3 months |

| Sole traders | 12 months |

Tip:

Regardless of whether you are required to prepare annual financial statements or are exempt, you cannot avoid an EÜR. In today’s digital age, you even have EÜR software that makes your bookkeeping much easier!

What dependencies does the financial year have on your company?

The timing of your financial year indirectly influences some of the dates in your company that are aligned with it. The influence of a financial year is particularly clear in the case of stock corporations and GmbHs . With both company names, certain deadlines for the meeting of the general meeting of German stock corporations or the general meeting of a GmbH must be observed.

The financial year also influences your accounting , as it is based on planning issues in order to achieve a comprehensible comparison of individual accounting periods .

What is a short fiscal year?

A short fiscal year is characterized by a length of less than twelve months . The short financial year is used when changing a financial year .

For example, if your company is set up in April, but you want to align your financial year with the calendar year in future, the short financial year covers a period of around nine months (April to December).